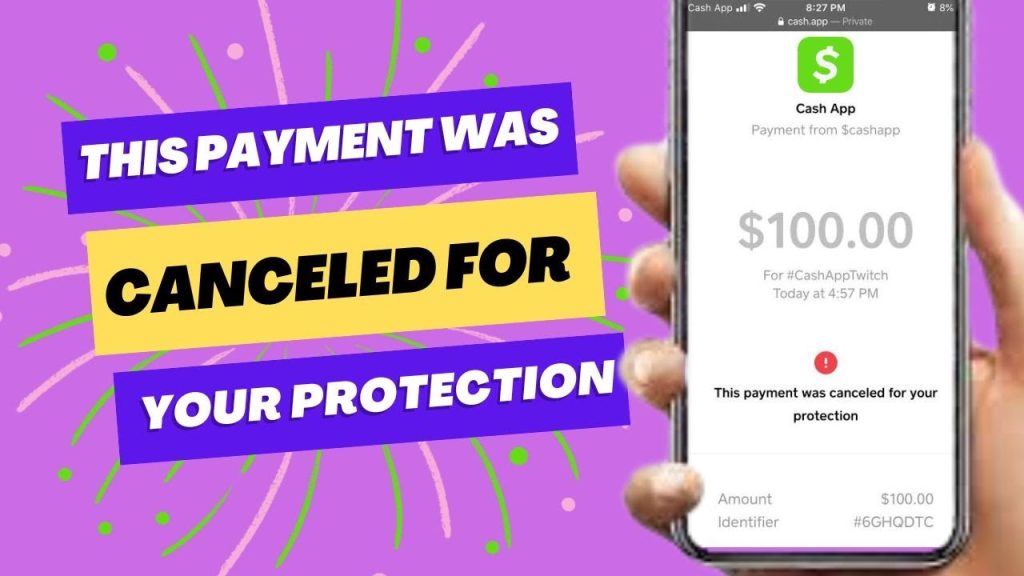

In the intricate web of digital transactions, encountering the disconcerting message of a Cash App failed for my protection can be perplexing. Let’s navigate through the nuances of this issue, understanding its implications, and why swift resolution is paramount.

Brief Overview of the Cash App Failed for My Protection Issue

The cryptic occurrence of a failed transaction on Cash App, supposedly for your protection, often leaves users befuddled. This is like a guardian algorithm, stepping in to halt a transaction that it perceives as potentially risky. But, decoding the specifics of this intervention is where the challenge lies.

Importance of Resolving the Problem Promptly

Understanding the urgency of addressing the Cash App failed for my protection matter is pivotal. Delayed resolutions can impede your financial fluidity and disrupt the seamless flow of digital transactions. In the fast-paced digital landscape, time is of the essence, and a stalled transaction could mean missed opportunities or essential payments.

Also Read: How To Fix Error 927 In Google PlayStore?

Understanding the Failed for My Protection Message

In the intricate dance of digital finance, encountering a Cash App failed for my protection message can feel like stumbling upon a locked vault. Let’s unravel the layers of this security feature, decoding the common error message and exploring the labyrinth of reasons that may trigger this safeguard.

Decoding the Common Error Message

The Cash App failed for my protection message is akin to a vigilant guardian, activating when a transaction raises eyebrows in the algorithmic realm. It’s a safety net, a virtual bouncer ensuring that your financial journey stays within the bounds of security.

Reasons Why Transactions May Trigger This Security Feature

Various factors can thrust a transaction into the protective embrace of the Cash App failed for my protection feature. It could be an unusual spending pattern, a location change, or even the time of the transaction. The algorithm, with its discerning eye, seeks anomalies that might signal potential risks, halting the process for your financial safety.

Common Scenarios Leading to Cash App Security Measures

In the intricate tapestry of digital transactions, encountering the shield of Cash App security measures is a testament to the platform’s commitment to financial safety. Let’s delve into the enigmatic triggers behind these measures, deciphering the subtle dance of algorithms that safeguard your financial realm.

Unusual Transaction Patterns

The algorithms embedded within Cash App possess a discerning eye for irregularities. Unusual transaction patterns, such as a sudden surge in spending or a deviation from your typical financial behavior, can activate the security measures. This vigilant scrutiny ensures that your funds are shielded from potential risks.

Multiple Failed Attempts in a Short Time Frame

In the digital realm, persistence is not always a virtue. Multiple failed attempts to execute a transaction within a condensed time frame can raise alarms. This preventive measure prevents potential threats, thwarting repeated efforts that might be indicative of unauthorized access or fraudulent activities.

Suspicious Activity Triggers

Cash App’s security measures are finely tuned to detect suspicious activity triggers. Whether it’s an unexpected location change, an unusually large transaction, or transactions during atypical hours, the algorithms are designed to scrutinize these nuances. This proactive stance ensures that your financial interactions remain guarded against potential threats.

Immediate Steps to Take When Faced with the Error

In the digital labyrinth of financial transactions, encountering an error can be disconcerting. Here’s a strategic guide on how to fix Cash App failed for my protection, ensuring a prompt and effective resolution to safeguard your financial landscape.

Stop Further Transactions

The initial response to a Cash App failed for my protection error should be decisive—stop further transactions immediately. This proactive measure prevents any potential escalation of issues and safeguards your funds from any additional risks.

Review Recent Transactions for Anomalies

A meticulous examination of your recent transactions is the next crucial step. Review recent transactions for anomalies—look for irregularities, unexpected amounts, or unfamiliar recipients. This detective work aids in identifying the root cause of the error and prevents its recurrence.

Check for Any Unrecognized or Suspicious Activity

A vigilant eye should be cast over your entire financial activity. Check for any unrecognized or suspicious activity within your Cash App. This comprehensive review helps unearth any potential security breaches, ensuring that your account is shielded from unauthorized access or fraudulent endeavors.

Verifying Your Identity on Cash App

In the dynamic realm of digital finance, ensuring the integrity of your transactions often starts with a fundamental step—verifying your identity on Cash App. Let’s embark on a journey through this process, understanding the nuances and emphasizing the significance of accurate information.

Navigating to the Account Settings

Initiating the identity verification dance requires a visit to the backstage—your account settings. Head to the Cash App interface, gracefully maneuver through the menus, and find the entryway to your account settings. This is where the curtain rises on the identity verification stage.

Completing the Identity Verification Process

Once in the sanctum of account settings, the identity verification process unfolds. Cash App, like a meticulous conductor, orchestrates a symphony of steps—photo verifications, personal details, perhaps even a dash of biometric authentication. Each note played is a layer of security, fortifying your digital financial identity.

Importance of Accurate and Up-to-Date Information

In this digital ballet, precision is paramount. The importance of accurate and up-to-date information cannot be overstated. Your financial profile is a canvas, and each brushstroke of information must be accurate. This not only streamlines the verification process but also ensures the seamless flow of your financial endeavors.

Contacting Cash App Support

In the intricate dance of digital transactions, encountering hurdles like a Cash App failed for my protection error is not uncommon. When the digital tides turn tempestuous, reaching out to Cash App support becomes a beacon of hope. Let’s delve into the art of seeking assistance, ensuring a smooth voyage through the sea of financial uncertainties.

Exploring In-App Support Options

Cash App, like a digital haven, offers a sanctuary within the app for users seeking assistance. Exploring in-app support options is the initial step in this quest for resolution. Unveil the support tab, a treasure trove of FAQs and guides, providing instant insights into common issues and potential solutions.

Providing Necessary Details for Efficient Assistance

When the journey through the in-app haven proves insufficient, engaging with human support requires precision. Providing necessary details—transaction history, error codes, and a concise description of the issue—transforms you into a collaborator with the support team. This detailed exposition empowers them to navigate the labyrinth of your digital challenge efficiently.

Understanding the Response Time and Potential Solutions

Patience becomes a virtue as you await the response from Cash App support. Understanding the response time and potential solutions is integral to managing expectations. The digital troubleshooters work diligently to decipher your conundrum, and a timely response heralds the potential resolution of your financial impasse.

Resolving the Issue Through Self-Help Measures

In the dynamic realm of digital transactions, encountering a perplexing challenge like Cash App failed for my protection can be disconcerting. Fear not, as we unravel self-help measures, equipping you with the tools to navigate through these digital intricacies.

Updating the Cash App to the Latest Version

Embarking on the journey to resolve the enigma, the first stride is upgrading your arsenal—the Cash App. Updating the Cash App to the latest version is akin to giving your digital companion a power boost. The latest iteration often carries bug fixes and security enhancements, fortifying your defenses against potential errors.

Clearing Cache and App Data to Resolve Glitches

Delving deeper into the digital labyrinth, clearing cache and app data emerges as a strategic move. Think of it as a spring cleaning for your digital workspace. Eliminating accumulated clutter and outdated information can untangle glitches, allowing for a smoother interaction with the Cash App ecosystem.

Ensuring a Stable Internet Connection

In this digital symphony, the stability of your internet connection is the conductor. Ensuring a stable internet connection is akin to providing a seamless stage for your financial transactions. A shaky connection could lead to disruptions, potentially triggering the elusive Cash App failed for my protection error.

Avoiding Common Pitfalls in Resolving the Issue

In the intricate landscape of digital transactions, resolving challenges like the elusive Cash App failed for my protection requires a strategic approach. Let’s explore the pitfalls and unveil a roadmap to steer clear of them.

Patience and Persistence in the Resolution Process

Embarking on the quest to fix the mysterious Cash App failed for my protection, patience becomes your trusted ally. The digital realm often demands a measured pace, allowing intricate processes to unfold. Patience and persistence transform you into a resilient navigator, weathering the storms of technological intricacies.

Being Cautious of Third-Party Solutions

In the pursuit of resolution, the digital highway is littered with tempting off-ramps—third-party solutions. Exercise caution, for these shortcuts might lead to dead ends or even exacerbate the issue. Being cautious of third-party solutions ensures that your journey is guided by the reliable landmarks of official support channels.

Regularly Updating Personal Information to Prevent Future Issues

Prevention often triumphs over cure in the digital realm. Regularly updating personal information is akin to fortifying your digital castle. Ensuring that your details are current acts as a proactive shield against potential future issues, reducing the likelihood of encountering the mysterious Cash App failed for my protection phenomenon.

Proactive Measures to Prevent Future Failed for My Protection Instances

In the dynamic arena of digital finance, anticipating and thwarting challenges like the cryptic Cash App failed for my protection is the hallmark of a savvy navigator. Let’s delve into proactive measures, erecting a shield against potential future encounters with this enigmatic phenomenon.

Understanding and Adhering to Cash App Terms of Service

The digital realm operates on a set of governing principles, much like the laws of physics. Understanding and adhering to Cash App terms of service is foundational. By becoming fluent in this digital lexicon, users preemptively align themselves with the platform’s protocols, reducing the likelihood of stumbling into the cryptic quagmire of a failed transaction.

Monitoring Account Activity Regularly

Vigilance is the currency of the digital realm. Monitoring account activity regularly is akin to standing sentinel at the gates of your digital fortress. Regular audits of transactions and account movements unveil potential irregularities, allowing users to nip issues in the bud before they evolve into more complex challenges, such as the elusive Cash App failed for my protection.

Implementing Additional Security Measures for Enhanced Protection

Elevating your digital defenses involves going beyond the standard protocols. Implementing additional security measures fortifies your digital fortress. Biometric authentication, two-factor authentication, and device encryption act as sentinels, adding layers of protection that go above and beyond the baseline, ensuring a robust defense against potential threats.